Simulations

Simulation Agents

Create AI-powered customer simulators to test your insurance sales agents

Simulation Agents

Simulation Agents (also called Simulator Agents) are AI-powered simulators that act as customers during your agent tests. They interact with your insurance sales agent, simulating real customer behavior and conversation patterns.What is a Simulation Agent?

A Simulation Agent is an AI that plays the role of a customer calling your insurance sales agent. Think of it as a sophisticated actor that can:- Simulate customer conversations based on prompts

- Control conversation flow and timing

- React naturally to your agent’s responses

- Provide consistent testing across multiple runs

- Follow scenario data to create realistic interactions

Why Simulation Agents Matter

Simulation Agents are crucial because they:- Eliminate human bias: Consistent behavior across all tests

- Scale infinitely: Run hundreds of tests simultaneously

- Cover edge cases: Test difficult customers and rare scenarios

- Save time & money: No need for human testers

- Provide 24/7 availability: Test anytime without scheduling

Creating a Simulation Agent

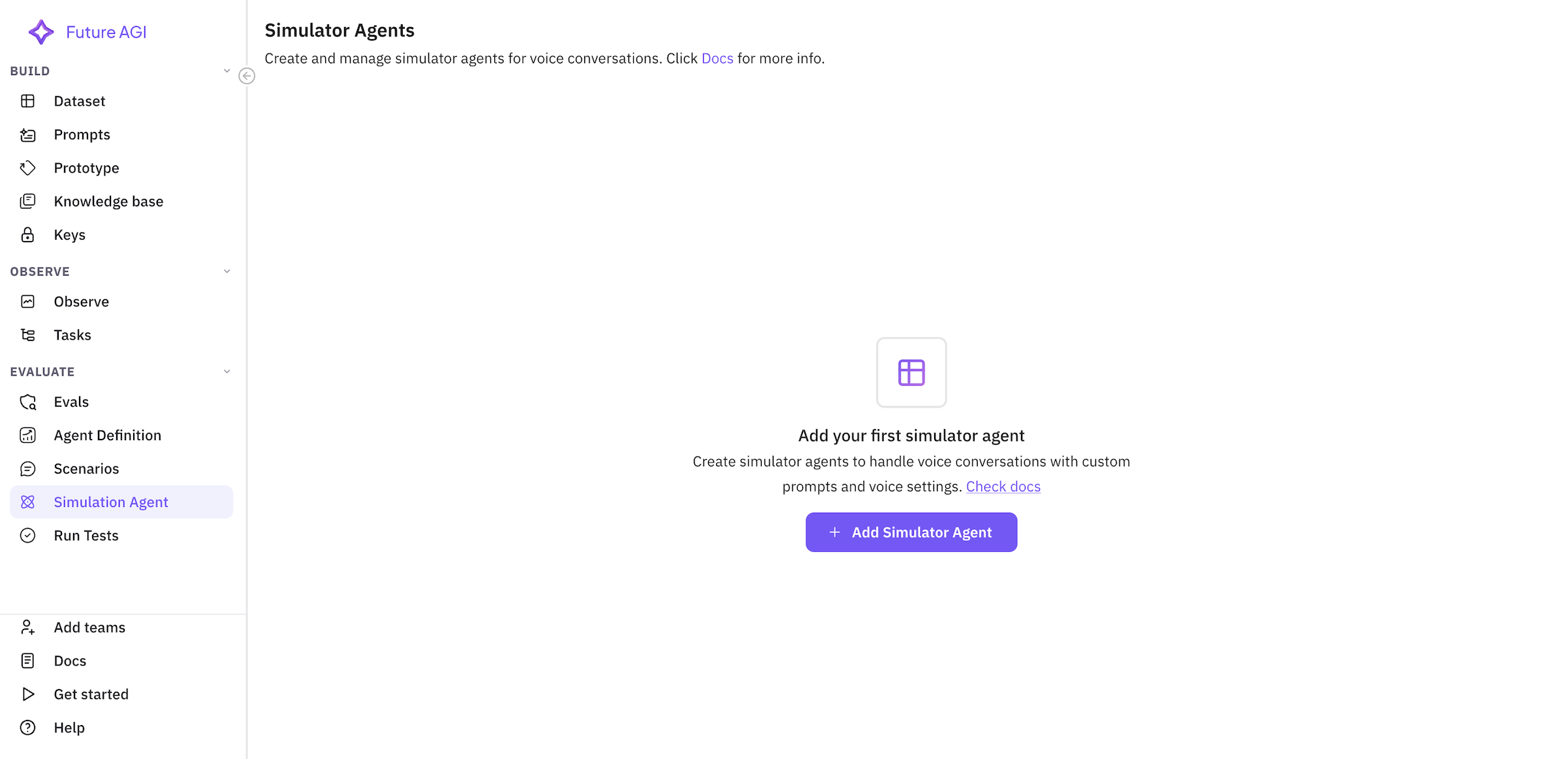

Step 1: Navigate to Simulation Agents

From your FutureAGI dashboard, go to Simulations → Simulation Agents Click “Add Simulator Agent” to create a new customer simulator.

Click “Add Simulator Agent” to create a new customer simulator.

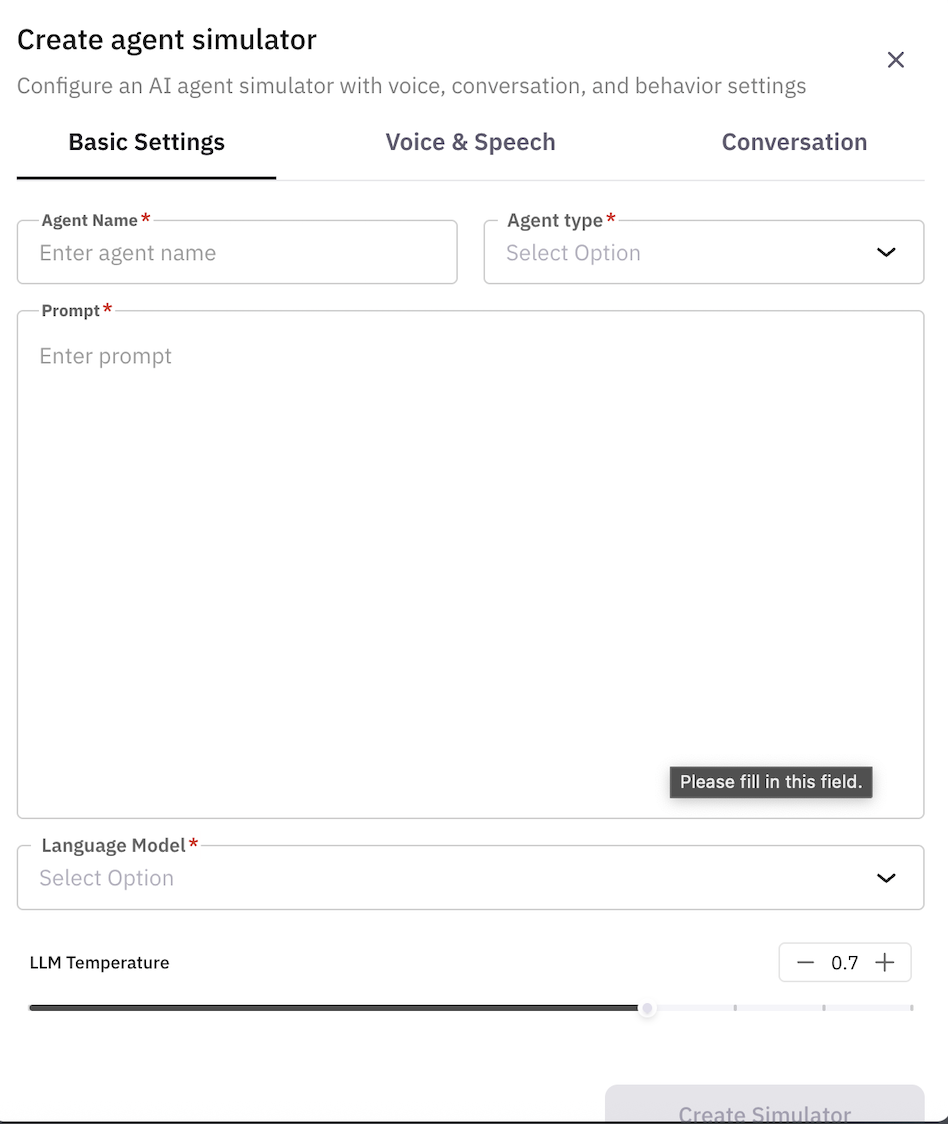

Step 2: Basic Information

Agent Name

Enter a descriptive name for your simulation agent:Budget-Conscious Insurance ShopperSkeptical Senior CustomerFirst-Time Insurance BuyerTech-Savvy Professional

Agent Type

- Choose between ‘voice’ or ‘chat’ depending on your use case.

Prompt

This is the most important field. The prompt defines your simulation agent’s personality, behavior, and conversation style. Write a detailed prompt that describes:Language Model

- Select the language model for the simulation agent (eg. ‘gpt’, ‘claude’ or your custom model)

LLM Temperature

- Set the temperature for the language model (0.0 to 1.0) (default: 0.7)

{{variable_name}} syntax to create dynamic, reusable prompts that adapt based on your scenario data. This makes your simulation agents more robust and versatile.

Example Prompt with Variables:

- Reusability: One simulation agent can handle multiple customer profiles

- Consistency: Ensures all test variations use the same base behavior

- Scalability: Easy to test hundreds of scenarios with one agent

- Maintenance: Update the prompt once, affects all test cases

- Data-Driven: Automatically pulls values from your scenario datasets

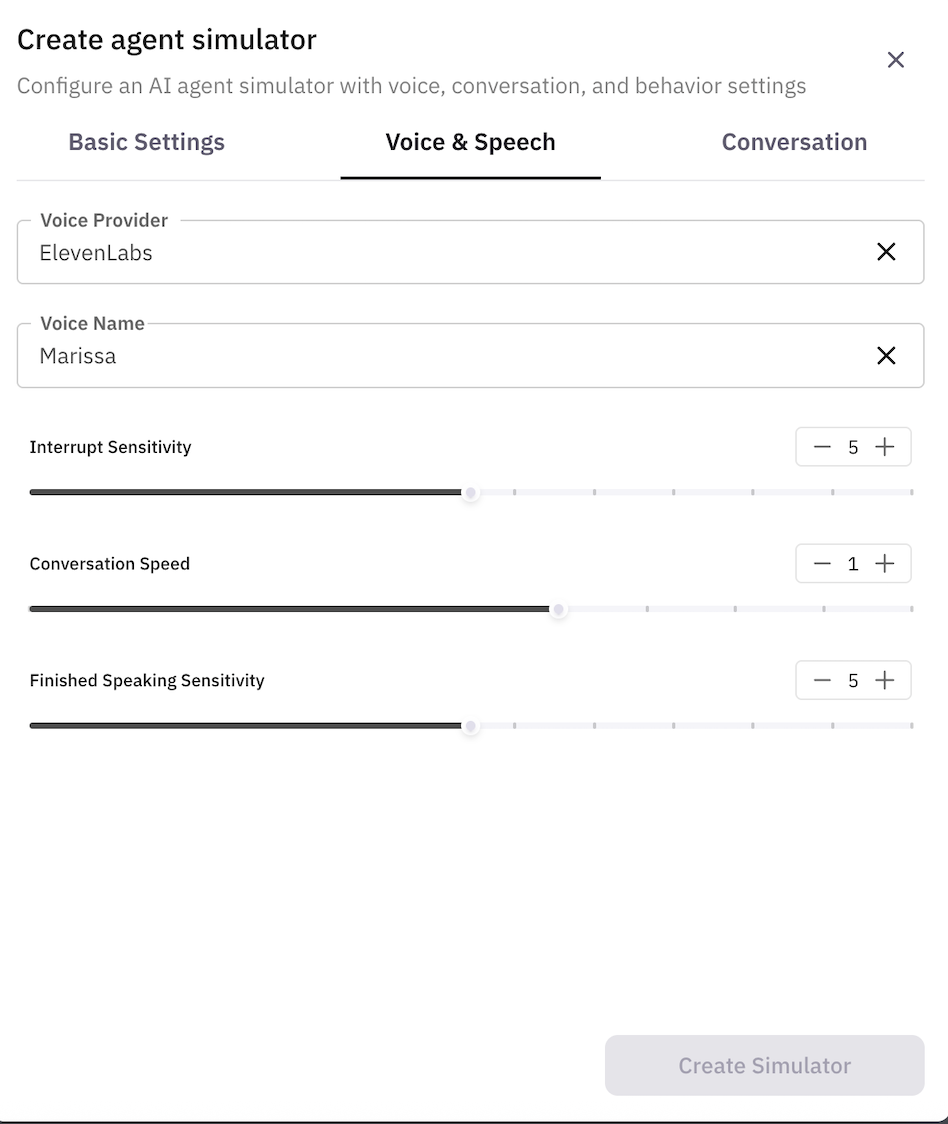

Step 3: Voice Configuration

Configure how your simulation agent sounds:

Configure how your simulation agent sounds:

Voice Provider

Enter the voice service provider (e.g.,ElevenLabs, Azure, Google, Amazon Polly)

Voice Name

Enter the specific voice ID or name from your provider (e.g.,Rachel, en-US-JennyNeural)

Interrupt Sensitivity

Controls how easily the agent can be interrupted (0-1 scale):- 0.0: Very difficult to interrupt

- 0.5: Normal conversation flow

- 1.0: Very easy to interrupt

Conversation Speed

Controls how fast the agent speaks (0.1-3.0 scale):- 0.5: Slow, elderly speaker

- 1.0: Normal speed

- 1.5: Fast, energetic speaker

Finished Speaking Sensitivity

Controls how the agent detects when the other party has finished speaking (0-1 scale):- 0.0: Waits longer before responding

- 0.5: Normal pause detection

- 1.0: Responds very quickly

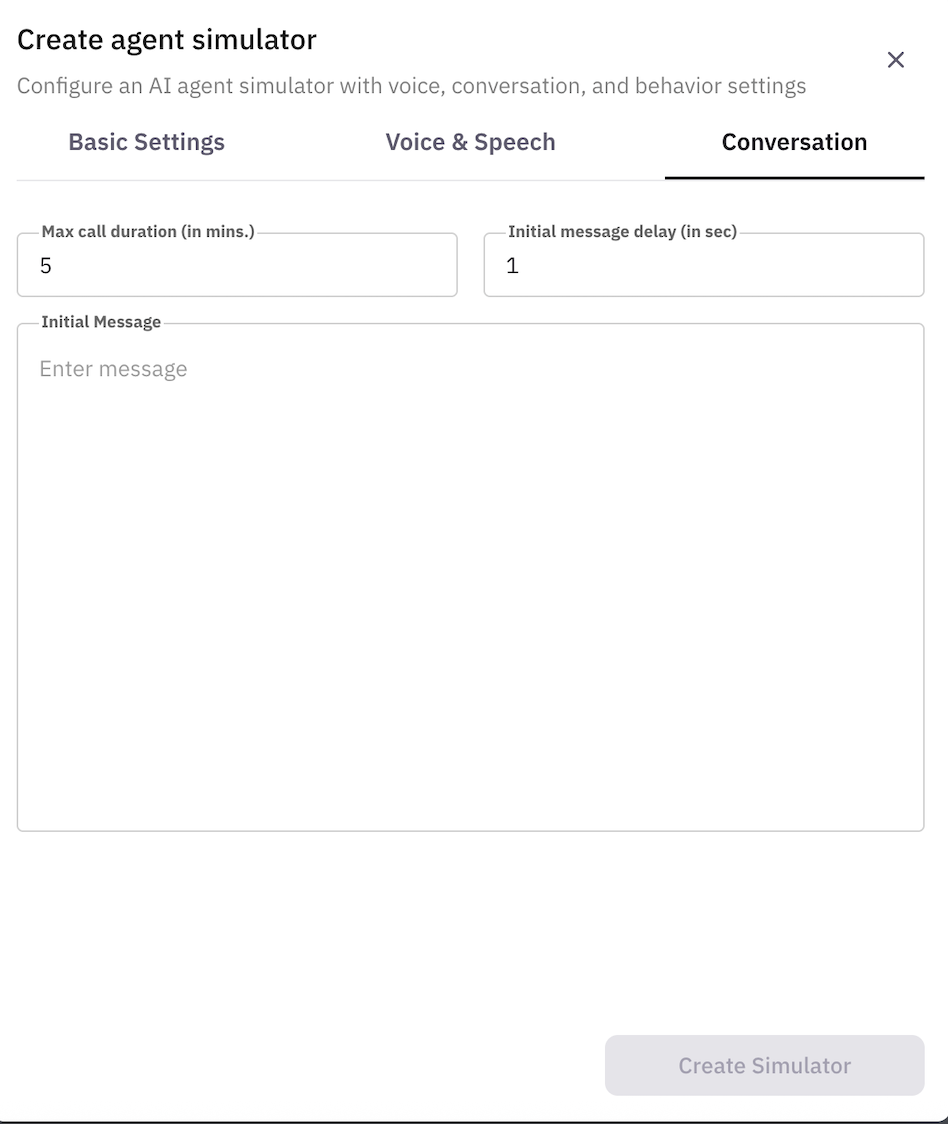

Step 4: Call Settings

Configure call behavior:

Configure call behavior:

Max Call Duration (minutes)

Set the maximum length of test calls (1-180 minutes)- Typical insurance sales calls: 15-30 minutes

Initial Message Delay (seconds)

Time to wait before the first message (0-60 seconds)- Simulates realistic call connection time

Initial Message (Optional)

What the simulation agent says first when connected:- Leave empty for agent to speak first (inbound calls)

- Add greeting for outbound simulation:

"Hi, I'm calling about life insurance options I saw on your website"

Example Simulation Agent Configurations

Example 1: Dynamic Customer with Variables

Example 2: Price-Conscious Young Family (Static)

Example 3: Advanced Template with Conditional Logic

Best Practices for Simulation Agents

1. Write Detailed Prompts

Your prompt is the foundation of realistic behavior:- Include demographic details

- Specify knowledge level

- Define conversation style

- List common questions and concerns

- Include realistic objections

- Replace hard-coded values with

{{variable_name}} - Variables are populated from your scenario data

- One agent can test multiple customer profiles

- Example:

{{age}}instead of “35”,{{income}}instead of “$75,000”

2. Match Voice to Persona

Choose voices that fit your testing agent:- Younger voices for millennials

- Professional voices for executives

- Regional accents if testing geographic markets

3. Calibrate Conversation Settings

Adjust settings for realism:- Seniors: Slower conversation speed

- Executives: Higher interrupt sensitivity

- First-time buyers: Lower finished speaking sensitivity

4. Test Different Scenarios

Create diverse simulation agents for comprehensive coverage:- Various age groups and income levels

- Different insurance knowledge levels

- Multiple conversation styles

- Various objection patterns

5. Iterate Based on Results

Refine your simulation agents:- Review conversation logs

- Adjust prompts for more realistic behavior

- Fine-tune conversation settings

- Update based on real customer patterns

Working with Variables

Available Variables

Variables in your prompts are automatically populated from your scenario datasets. Common variables include:- Demographics:

{{name}},{{age}},{{gender}},{{location}} - Financial:

{{income}},{{budget_monthly}},{{credit_score}} - Insurance:

{{insurance_interest}},{{current_insurance}},{{coverage_amount}} - Behavioral:

{{objection_type}},{{urgency_level}},{{knowledge_level}} - Family:

{{family_status}},{{dependents}},{{spouse_employed}}

Variable Naming Conventions

- Use lowercase with underscores:

{{annual_income}}not{{AnnualIncome}} - Be descriptive:

{{preferred_contact_time}}not{{pct}} - Match your dataset column names exactly

Testing Your Variables

Before running full tests:- Check that variable names match your dataset columns

- Preview a test with one scenario to verify variable replacement

- Ensure all required variables have values in your dataset

Common Use Cases

Sales Training Validation

Test if your insurance agent can:- Handle price objections effectively

- Explain products clearly

- Build rapport with different personalities

- Close sales appropriately

Compliance Testing

Ensure your agent:- Provides required disclosures

- Doesn’t make false promises

- Handles sensitive information properly

- Follows regulatory guidelines

Product Knowledge Assessment

Verify your agent can:- Explain different insurance types accurately

- Answer technical questions

- Provide appropriate recommendations

- Handle complex scenarios

Troubleshooting

Simulation Agent Too Predictable

- Increase LLM temperature

- Add more variety to prompt

- Include multiple persona traits

Conversations End Too Quickly

- Add more questions to prompt

- Increase engagement instructions

- Adjust finished speaking sensitivity

Unrealistic Behavior

- Review and refine prompt

- Check conversation speed settings

- Ensure voice matches persona

Next Steps

With your simulation agents created, you’re ready to:- Create test configurations combining agents and scenarios

- Execute simulation tests to evaluate performance